Despite recent signs of improvement in the overall economy in Africa’s largest economy, reality is that South Africa’s fiscal landscape is strained, with national government gross debt projected at R6.09 trillion for FY2025/26 (April 2025–March 2026), per the National Treasury’s May 2025 Budget Review.

This equates to a conventional debt-to-GDP ratio of 77.4%, up from 76.9% in FY2024/25, amid sluggish growth (1.1% real GDP expansion forecast for 2025) and rising interest costs. Nominal GDP is estimated at R7.87 trillion (US$426.38 billion at ~18.5 ZAR/USD).

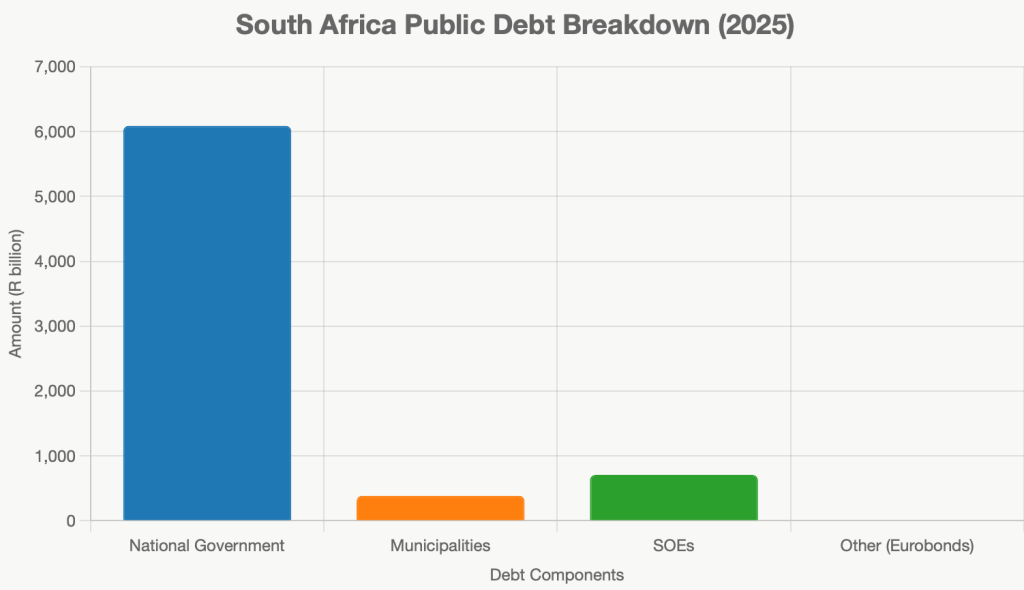

This figure however hides a much broader debt burden, that unless addressed urgently holds the potential to drive a full blown economic crises. There is in addition a large SOE and municipality debt burden that brings the total national debt to around R7,184 billion, which equates to a revised debt-to-GDP ratio of 91.3%.

The Government has just raised R11 billion via a eurobond issuance, that is intended to support infrastructure improvements. This should not be celebrated but rather should come with more caution. What will be vital will be the effective deployment of this capital with strict accountability and targeted projects aimed at potential growth sectors, without the commonplace corruption that has characterised most of the infrastructure projects in the last two decades.

Positive signs such as the removal of the country from the FAFT “grey List” and the recent S&P rating upgrade, as well as consumer sentiment shifts, while welcome, do not hold the key to financial recovery. This can only be addressed by solid economic growth, and nothing else. To do that the government will need a reset from its current trajectory and to start investing capital in economic growth areas such as energy and transport infrastructure and away from short-term expenditure wastage.

Full Spectrum of Public Debt

The “full spectrum” expands beyond national debt to include municipal liabilities and state-owned enterprise (SOE) debt/contingent liabilities (e.g., Eskom, Transnet, SAA, Post Office). These are often off-balance-sheet but burden the fiscus via bailouts and guarantees, as most SOEs remain unprofitable (e.g., Eskom’s R372 billion debt despite a R16 billion profit in FY2024/25; Transnet’s R150 billion). Recent eurobond issuances add around R75 billion (US$3.5 billion dual-tranche in December 2025, plus R11.8 billion infrastructure bond).

| Component | Debt/Liabilities (R billion) | % of Total Public Debt | Notes |

|---|---|---|---|

| National Government | 6,090 | 84.8% | Gross loan debt; stabilized at 77.4% GDP. |

| Municipalities | 386 | 5.4% | Total liabilities (incl. R75B borrowings, R132B creditors); consumer arrears to munis R416B (not included as owed to them). |

| SOEs (Eskom, Transnet, SAA, Post Office, etc.) | 708 | 9.9% | Contingent guarantees; Eskom R372B, Transnet R150B, SAA/Post Office ~R20B each; total SOE support ~R500B since 2009. |

| Total Public Debt | 7,184 | 100% | Excludes private debt; consolidated public sector = 85–90% of GDP (per IMF/SARB estimates). |

Revised Debt-to-GDP Ratio: Incorporating municipalities and SOE contingents yields ~91.3% of GDP (R7.184T / R7.87T). This is higher than the headline 77.4% but aligns with broader public sector metrics (79.5% incl. local gov alone). Excludes indirect burdens like Eskom’s R102–103B municipal arrears.

Debt Servicing Costs

Debt service (interest payments) for FY2025/26 is estimated at R400 billion, up 3.8% YoY but down from 7.4% projected earlier due to lower rates (repo at 6.75%). This consumes ~15.5% of the R2.58 trillion national budget (total expenditure), exceeding spending on education/health combined and crowding out growth investments. As % of GDP: ~5.1%. Treasury bailouts for unprofitable SOEs (e.g., R80B to Eskom in 2025/26) exacerbate this, with guarantees totaling R708B.

Per Capita Debt

With a mid-2025 population of 64.75 million, total public debt equates to ~R110,900 per person (US$6,000 at 18.5 ZAR/USD)—a heavy load for a middle-income economy with 31.9% unemployment.

Current National Debt Breakdown for South Africa

Required GDP Growth to Overcome Debt Burden

At 1.1% real growth, debt/GDP is stabilizing but not declining meaningfully, per IMF projections (rising to 80.1% by 2028 without reforms). To reduce to 70% by 2033 (Treasury’s stated goal), South Africa needs a sustained 2.5–3% real growth annually, paired with a 3% primary budget surplus (revenues minus non-interest spending). This would generate between R200–250B extra revenue yearly, easing bailouts, boosting infrastructure (target of 15% GDP investment vs. current 13%), and creating 300,000+ jobs via multipliers (1% growth adds around 100,000 jobs).

Key enablers for growth: Energy stability and price easing, logistics reforms (e.g., Transnet), and private investment via Operation Vulindlela. Without this, South Africa’s debt could hit 86% of GDP by 2030, stifling employment (youth unemployment rate = 45%), and leading to a catastrophic economic melt-down.

The question of continuing down a debt and poorly administrated, corruption tainted path, is no longer a possibility and the only question is – will the South African government reform itself or is there the dire need for a new government that will seek to build up the countries economy again.