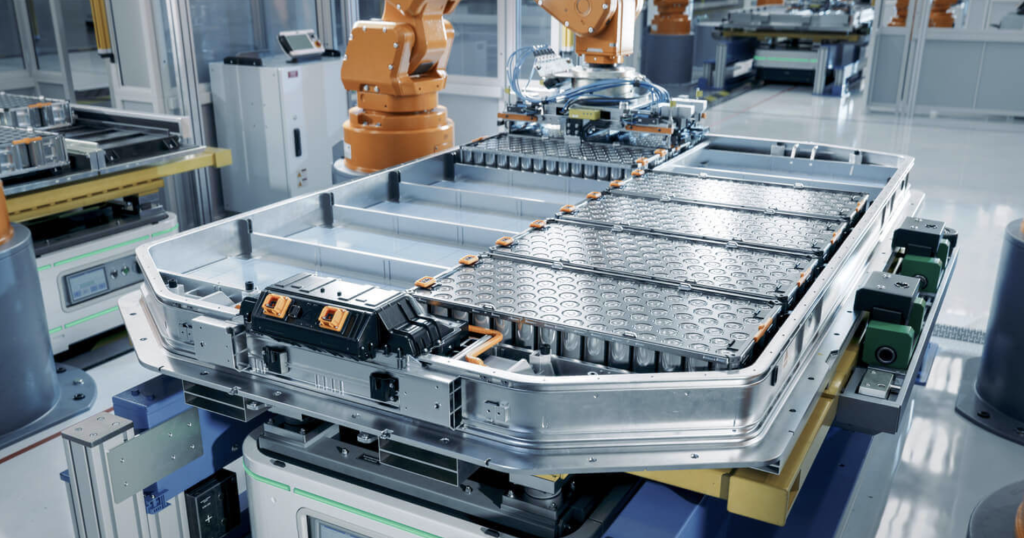

As the global electric vehicle (EV) race accelerates toward full charge, Electric vehicles and grid-scale storage are driving sustained demand for lithium, cobalt, nickel, manganese and graphite. This demand is altering the balance of power along battery supply chains, concentrating profits and technical capability in processing and manufacturing rather than in extraction alone. For mineral-producing economies, continued reliance on raw exports sets a firm limit on industrial development.

For decades, the dominant model has been simple export raw ore or concentrate, import finished products. While this approach delivers foreign exchange, it captures only a fraction of the economic potential embedded in battery minerals. The real margins sit further downstream in refining, precursor chemicals, cathode and anode materials, and eventually battery cells. Shifting even part of this chain onshore can transform a low margin extractive sector into an engine for industrial growth.

Why Value Addition Matters

The case for value addition is straightforward. Exporting unprocessed material limits job creation, weakens local supplier development and leaves countries exposed to commodity price swings. In contrast, midstream and downstream activities generate skilled employment, encourage technology transfer and create export products with far higher and more stable value. Battery manufacturers and automakers are also increasingly demanding traceable, ESG-aligned supply chains, making industrial upgrading not just an economic choice but a market requirement.

Despite strong mineral endowments, Africa’s participation in battery value chains remains heavily weighted toward extraction. However, momentum is building. Industrial strategies now emphasise beneficiation, while incentives are being designed to attract refineries, chemical plants and battery component manufacturers. Rather than attempting to replicate entire global supply chains, policymakers and investors are beginning to focus on targeted entry points where scale, skills and resources align.

Conditions and Risks in Moving Downstream

Getting value addition right requires more than ambition. Predictable regulation, competitive energy supply and investable infrastructure are non-negotiable. Investors also need clarity on export rules, royalties and long-term policy direction. Where these fundamentals are in place, partnerships with experienced global firms can accelerate progress, particularly when structured around offtake agreements, joint ventures and local skills development.

There are also risks in overreach. Battery technology is evolving rapidly, with some chemistries reducing reliance on certain minerals while increasing demand for others. Countries that bet on a single mineral or technology risk being left with stranded assets. A more resilient approach is to focus on flexible midstream capabilities such as refining, precursor production or recycling that can adapt as battery chemistry changes. Regional collaboration can further improve viability by aggregating supply and demand across borders.

A Practical Pathway Forward

A practical pathway begins with beneficiation and battery grade refining, supported by skills development and dependable infrastructure. From there, expansion into precursors and selected components becomes viable where scale and logistics align. The objective is durable competitiveness, not symbolic manufacturing capacity. Battery minerals sit at a strategic junction in the energy transition. Countries that continue exporting them in raw form will remain exposed to price cycles and external decision-making. Those that invest in disciplined value addition strategies can convert geological endowment into lasting industrial capability.