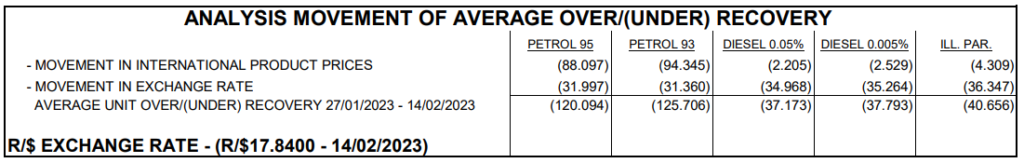

The Central Energy Fund (CEF) mid-month statistics indicates that both diesel and petrol drivers in South Africa will face fuel price increases in March 2023.

The snapshot data for 14 February 2023 suggests a price rise of up to R1.26 per litre and 38 cents per litre for petrol and diesel, respectively.

The following are the anticipated changes:

- Petrol 93: increase of 126 cents a litre;

- Petrol 95: increase of 120 cents a litre;

- Diesel 0.05%: increase 37 cents a litre;

- Diesel 0.005%: increase of 38 cents a litre;

- Illuminating paraffin: increase of 41 cents a litre.

The Department of Energy has underlined that the daily snapshots are not predictive and do not account for other potential changes such as slate levy adjustments or retail margin changes, which are calculated by the department at the end of the month after taking into consideration all aspects.

The Department of Education makes revisions after reviewing the full time. Furthermore, the picture may alter dramatically before the conclusion of the month. Finally, the anticipated price adjustments are dependent on present market circumstances continuing until the end of the month.

As observed in February, market circumstances at the beginning of the month indicating a price decline were fully reversed by the end of the month, indicating a price gain.

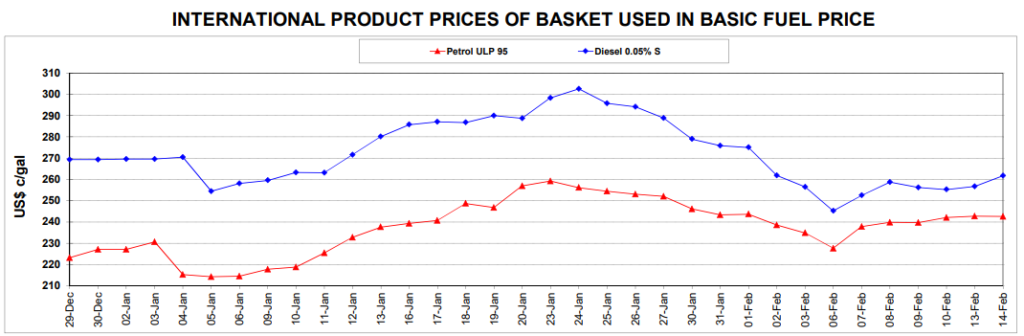

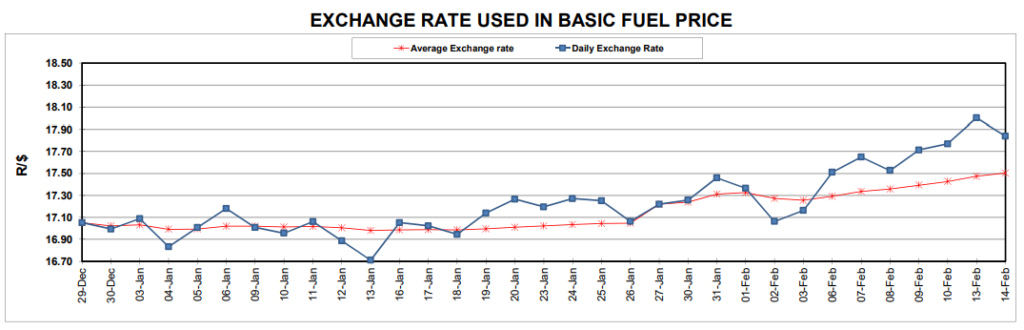

The changes in local fuel costs are influenced by two major factors: the worldwide price of petroleum goods, which is mostly determined by oil prices, and the rand/dollar exchange rate used to purchase these items.

Both oil prices and the rand have been working against motorists in the first two weeks of February, adding to an overall under-recovery in gasoline costs. Oil prices, which influence international product pricing, have steadily begun to rise, while the rand has fallen dramatically versus the dollar.

The price of oil

Oil markets throughout the world have been unpredictable in recent months, and this volatility has persisted into February.

Oil prices climbed at the end of January as markets projected tighter supply as a result of China ending its zero-covid policy and reviving its economy, as well as limits from sanctions on Russian oil and a coordinated effort by OPEC+ members to cut output.

However, these anxieties were alleviated as markets bided their time to see if these possibilities would play out. This maintained oil prices largely constant, without rising far beyond $87 per barrel.

Analysts predict that prices will grow in the future, potentially exceeding $90 or $100 per barrel, but that they will remain range-bound in the short term.

Bloomberg experts recently predicted that oil prices will fall in the short term as US oil producers built stocks. However, other destabilising forces remain in play, notably Russia’s continuing conflict against Ukraine.

Oil is currently trading at around $85 a barrel.

Rand exchange

The rand’s weakness versus the dollar keeps pressure on local fuel costs, contributing to a worse under-recovery for diesel than for oil.

The local currency is now under pressure from both global factors, such as a higher dollar, and domestic flaws, such as the prolonged power crisis and political instability surrounding President Cyril Ramaphosa.

On the global front, higher-than-expected US inflation figures have resulted in a bearish forecast for interest rates in the world’s largest economy. This has resulted in a risk-off climate, which has weakened emerging market currencies such as the rand.

Local conflicts, on the other hand, have aggravated the problem. South Africa is presently witnessing the greatest levels of load shedding on record, with rolling blackouts affecting every single day of the year and lasting more than 100 days.

In his state of the country speech, President Cyril Ramaphosa sought to ease worries and concerns about the power issue. Unfortunately, the market reaction to the president’s speech was muted, with investors sceptical by his intentions.

The rand is presently trading at R18.00 per dollar, having exceeded that level earlier this week.

This is how the expected price changes could reflect at the pumps:

| Inland | February Official | March Expected |

| 93 Petrol | R21.38 | R22.64 |

| 95 Petrol | R21.68 | R22.88 |

| 0.05% diesel (wholesale) | R21.32 | R21.69 |

| 0.005% diesel (wholesale) | R21.41 | R21.79 |

| Illuminating Paraffin | R15.84 | R16.25 |

| Coastal | February Official | March Expected |

| 93 Petrol | R20.73 | R21.99 |

| 95 Petrol | R21.03 | R22.23 |

| 0.05% diesel (wholesale) | R20.67 | R21.04 |

| 0.005% diesel (wholesale) | R20.77 | R21.15 |

| Illuminating Paraffin | R15.05 | R15.46 |